Marine Insurance Policies are recognized as the forbearer for the modern-day insurance industry. Since as early as 3000 B.C, the Chinese merchants felt the need to protect themselves from an array of unique risks and challenges of sailing the high seas.

Ocean marine insurance encompasses a variety of coverages designed to protect merchandise, goods, workers, passengers, and crews aboard shipping vessels and cargo storage during marine transport domestically or abroad.

Why one need Marine Insurance?

With the advent of the blue economy and its essential contribution to the global economy, there is an increasing need for most manufacturing and distribution operations to secure themselves with Ocean Marine Coverage. combating the threat posed by a host of natural and man-made hazards, companies also have to deal with the demands of a less forgiving regulatory and legal environment and emerging risks posed by our growing reliance on technology. All of these factors can combine to impair the successful running of operations, Hence, Ocean Marine Insurance has a vital role to play as it transfers the liability (limited) of the goods from the parties and intermediaries involved to the insurance company.

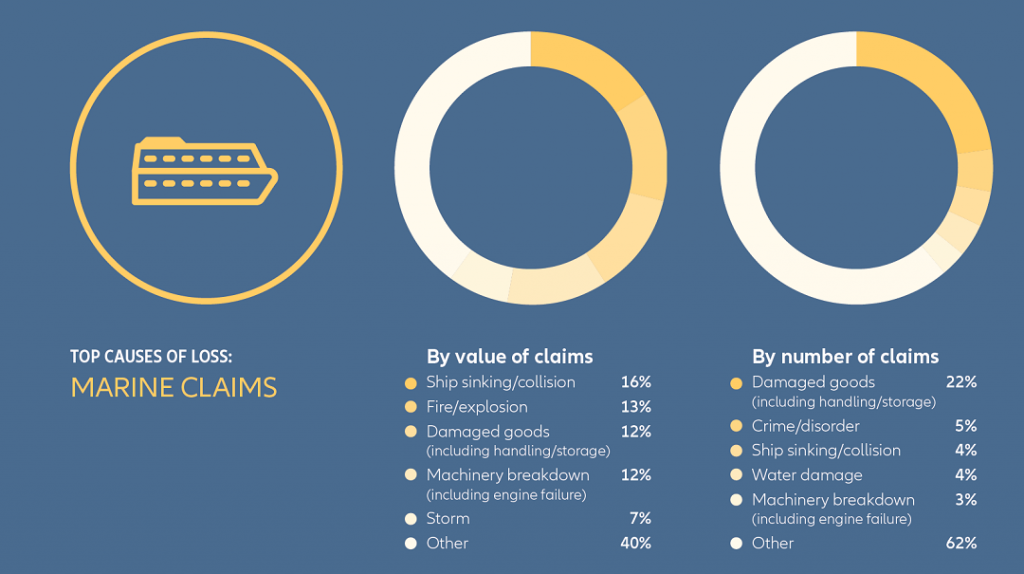

Here are statistics that illuminate the significant exposure to risk for ships and their cargo:

- Marine claims trends 2018- Allianz Global Corporate & Speciality

The main types of vessels that qualify for Marine Insurance coverages are:

The major types of vessels included in the coverage have expanded over time to offer financial protection to owners of the vessels. Following are the vessels that qualify for the coverage:

· Container Ships

· Yachts

· Barges

· Fishing boats

· Ferries

· Tugboats

· Tankers

· Sailing Charters

· Oceanic Research Vessels

Three crucial coverages:

Ocean Marine Insurance is an umbrella term for three crucial coverages, namely, hull coverage, cargo coverage, and liability coverage.

1. Hull Coverage:

As Hull refers to the main body of the ship, Hull and Machinery Insurance (H&M) is designed to cover certain types of physical damage to the vessel and its operating machinery and equipment. It is purchased by the shipowner or main party that is responsible for the ship’s physical well-being. The categories of marine incidents included in hull coverage are Accidents, collisions, fire/explosion, grounding, tidal waves. In addition to floating equipment, it can also benefit offshore oil rigs. “Container ship fires are a potentially growing volatile source of claims as ships become larger and carry more and more cargo. If action is not taken to tackle this issue, fires onboard container ships will continue and they will become larger and more costly,” says Duncan Southcott, Marine Claims Specialist at AGCS.

Example

The Maersk Honam fire in March 2018 destroyed around one-third of the 7,800 containers (about 12,000 TEU on board the vessel at the time. This fire follows other similar incidents, including the 13,800 TEU, MSC Daniela in 2017 and several incidents during 2016 including the 9,000 TEU, CCNI Arauco, which caught fire in Hamburg

2. Ocean Marine Cargo Coverage?

Ocean Marine Cargo Coverage covers the losses to cargo while the ship is sailing in the oceanic waters. This type of insurance is mainly beneficial for oil tankers and other heavy cargo-carrying ships. For a significant number of businesses, cargo shipments are an essential source of revenue, hence, damage to it without any coverage can certainly impact the company’s bottom line. “The cargo market has experienced many large claims, but there is simply not enough premium to pay for catastrophic or unusually large losses,” says Southcott. “We are seeing much greater claims volatility with the higher accumulation values of cargo on larger ships and in warehouses,” says Southcott.

The cargo insurance provides the insurer with the choice depending on how frequently his/her business makes use of shipments: Open cargo policy is a convenient cover for businesses with regular shipments as it covers the overall shipments made by a company during the defined policy period, Whereas Specific cargo policy is a convenient coverage for small businesses that make periodic shipments as it ensures cargo for a single voyage.

Example:

A boutique retailer selling women’s apparel imports a shipment of clothes from a supplier in Vietnam. Unfortunately, a fire onboard the container ship transporting the items causes irrevocable damage to the goods—worth an estimated $100,000. The retailer files a claim against their Ocean Marine Cargo Insurance policy and receives a $100,000 payout from the insurance company.

What is Ocean Marine Liability Coverage?

Ocean Marine Liability coverage is also known as Protection and Indemnity Insurance is a third-party liability risk coverage against the liabilities associated with the ownership and operation of an ocean vessel. It includes losses related to illness, injury, loss of life, medical expenses, damage to other vessels and property, damage to cargo, wreckage removal, and quarantine expenses, war and political risk, oil spill & pollution civil liabilities.

Example:

The Deepwater Horizon oil spill in 2010 discharged 4.9 million barrels of oil into the Gulf of Mexico and instigated one of the largest environmental disasters in U.S history. The MW Sewol passenger ferry in South Korea capsized near the Jeju coast and resulted in the death of 304 passengers and crew in 2014. More recently, a Norovirus outbreak sickened 475 passengers on a Caribbean cruise ship in January 2019.

Disclaimer: The information contained is purely based on reports available on an online platform. The company is not responsible for the content and will not be responsible for any decision made on the basis of such information.