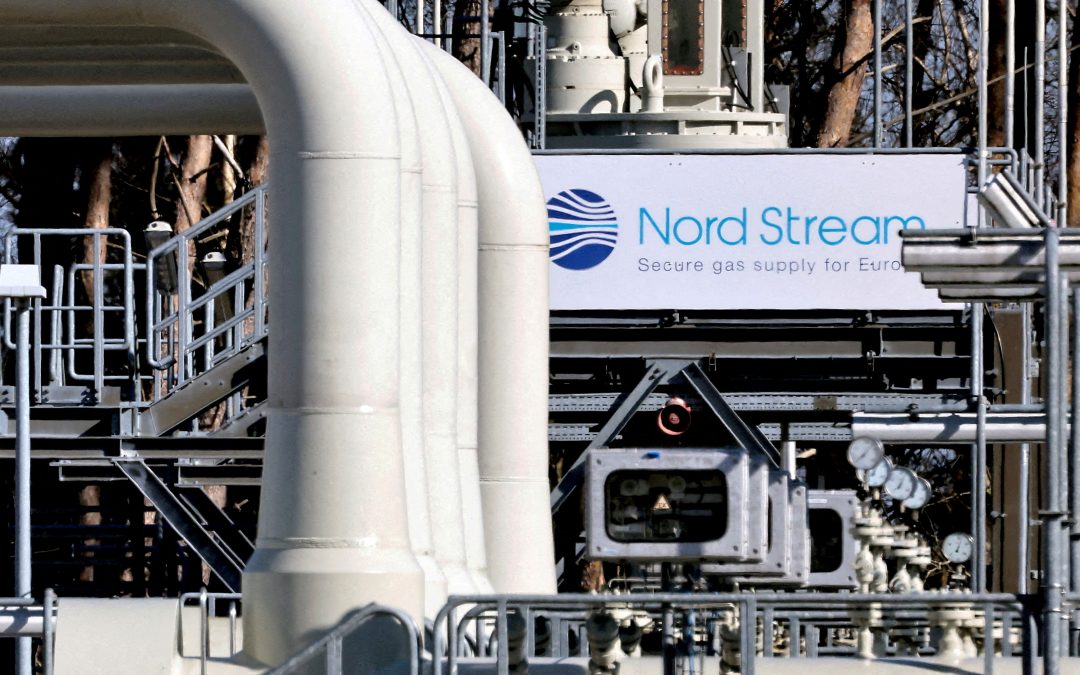

European gas prices have soared as flows from Russia through the Nord Stream 1 pipeline stay low, exacerbating the region’s energy woes, a report by Rystad Energy showed.

Norwegian exports to the UK also slipped due to a breakdown at the Sleipner export hub, which further put pressure on prices.

The European Title Transfer Facility — a virtual trading point for natural gas in the Netherlands — front-month prices remained high at about $61.59 per million British thermal Units (MMBtu) on Thursday, as Europe revised its temperature forecasts, the report said.

Russian gas company Gazprom cut shipments on the Nordstream pipeline to Germany to 20 per cent of capacity last month, citing issues with turbines. The move sent gas prices to the highest levels since March.

“TTF prices will continue at high levels so long as gas supply from Russia appears to remain tight in the foreseeable future,” Rystad analyst Lu Ming Pang said in a note.

“The Nord Stream 1 pipeline continues to export gas from Russia into Europe at 20 per cent capacity, which is roughly 33 million cubic metres per day [MMcmd].”

Gazprom claimed that Nord Stream 1 is only capable of operating at 20 per cent capacity as only one out of five compressors is in operation at the moment.

The ongoing compressor transfer situation between Siemens and Gazprom has not yet been resolved, with Siemens claiming that Gazprom is still not facilitating receipt of the compressor into Russia despite all the relevant customs documents being in place.

Gazprom said it required additional documents to ensure the compressor will not violate sanctions imposed by the European Commission.

EU countries are taking several steps to reduce gas use, both through an overall regional agreement as well as more specific measures by individual countries and companies, Rystad said.

Earlier this week, the EU’s plan to reduce gas consumption by 15 per cent between August and March came into effect as the bloc prepares for the winter months.

The final package is a compromise in which the cuts are initially voluntary and could become mandatory if enough countries request it. A number of members, including island states, can claim exemptions.

The EU is currently struggling with a tight gas supply to fill storages to the agreed 80 per cent by November 1, Rystad said.

Countries that are typically more reliant on Russian pipeline gas such as Germany and Italy have set higher targets before the winter, with Germany aiming for 75 per cent by September, 85 per cent by October and 95 per cent by November.

Meanwhile, Italy has set a target for 90 per cent by November.

Meanwhile, the US has overtaken Russia as the biggest exporter of liquefied natural gas to Europe after the war in Ukraine, which led to western sanctions on Moscow’s energy imports.

Gas shipped from the US now accounts for nearly half of Europe’s LNG imports, following a significant decline in the amount delivered by pipeline by Russia.

The US provided 47 per cent of Europe’s total LNG imports in the first half of the year, figures compiled by the US Energy Information Administration showed.

Its analysis also showed that LNG imports in the EU and UK increased by 63 per cent during the first half of 2022.

Source: Hellenic Shipping News